When structuring equity in a tech spinout there are lessons that can be learned from private equity’s approach to cap tables.

Private equity has matured its methods over decades. Modern private equity took off over the 1980s, when most of the big name private equity funds we know today were established. Today, private equity generally focuses on making fewer, larger investments in established businesses or assets1.

Private equity firms and managers have developed solutions to a whole raft of problems and situations a business can face.

While a new spinout or joint venture between two established companies may seem different to a private equity backed business – and in some ways it is – there are also similarities.

We will review cap tables of private equity businesses by looking at three example case studies. Through these case studies we will look at how the company starts, what each party contributes and how the cap table evolves. The case studies are:

- Invest alongside founders

- Buy control of business

- Multi-stage, multi-investor journey

After the case studies we’ll look at how reality can vary from them and the lessons to be learnt.

Please keep in mind while reading that complexity and nuance will be missed but it is missed on purpose so as not to distract from the focus here, which is just to give an overview of private equity style cap tables. There are better guides and resources available elsewhere for detailed analysis and thinking on private equity cap tables.

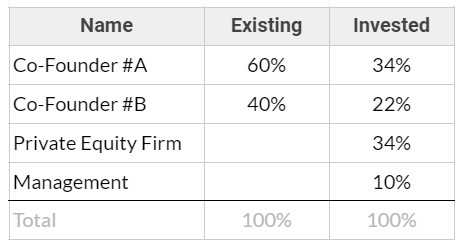

Case Study #1: Invest Alongside Founders

One scenario for a business is where a private equity firm makes an investment in an existing business.

The business was started by two co-founders who built it to a meaningful size.

A private equity investment is made and the firm gets to work on the business to be on the journey with the founders or existing shareholders for the next few years to build enterprise value.

The valuation of the business is increasing at each stage and the percentage of ownership will likely look like this:

Table 1: Invest alongside founders

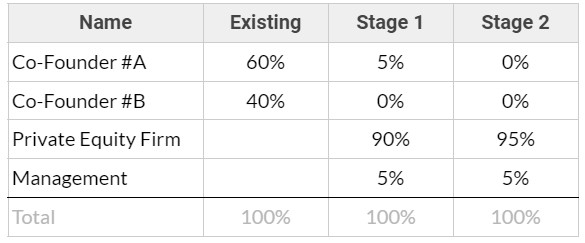

Case Study #2: Buy Control of the Business

A business is built to a meaningful size by two co-founders like the example above. Then, a private equity firm effectively buys the business.

The acquisition of the business may see one or more of the co-founders remain with equity while others leave. This may also be done in stages (sometimes called tranches).

Often new management is bought in with the buyout or existing management is incentivised with equity or equity-like instruments to align them with the investor.

Here is what the equity in a buyout might look like:

Table 2: Buy control of the business

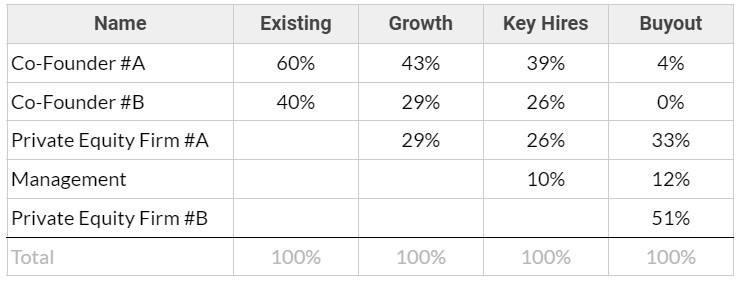

Case Study #3: Multi-stage, Multi-investor

Often the pathway for a private equity company will see a private equity firm or two invest at one stage of the business then progress it to the next where a later stage investor gets involved to continue growing the business.

At the beginning of this companies private equity journey you have:

- Two co-founders: they start the company and build it to a meaningful size.

- PE Firm A: this private equity firm invests in the business to work with the founders to build the business further.

A year or so in key management hires are bought in and incentivised with equity.

Then, after some hard work and a bit of luck, the firm grows and a new firm, PE Firm B, buys into the business.

The table below shows what this journey might look like:

Table 3: Cap Table for a Multi-stage, multi-investor journey

Sliding Scale

Sometimes it isn’t a binary scenario like those described above that plays out. For example:

- It might be that private equity comes in as an investment then increases their holdings to a buyout overtime.

- It might be that management does a buyout to rebuy the company

- It might be that founders buy the business back

- It might be that performance criteria aren’t met and control changes hands

These are all fairly common so worth considering at the outset of a venture.

What Else Can We Learn From Private Equity Cap Tables?

There are some other aspects to private equity businesses that are worth considering:

- Private equity firms almost always include various terms that don’t show up in the cap table. These could be terms that protect their investment should the value of the business decline, allow them to see proceeds from a sale first or increase their shareholding where performance isn’t met. They like to get creative in protecting themselves.

- Private equity firms may also find ways to recoup their investment or fund their involvement by getting cashflow from the business in different ways. This could be through charging fees, paying dividends or taking a clip of revenue.

- Private equity firms may combine debt with their investment to get leverage.

- Private equity firms, like venture firms, want the team incentivised.

Next

In the next part of the guide we will look at structuring the equity of a new tech joint venture.

Again, it needs to be emphasised that this review of private equity cap tables has taken a simplistic view to suit the purposes of this guide to tech spinout equity.

You may also want to read other parts of the Guide to Tech Spinout Equity:

Footnotes:

- Technically private equity encompasses venture capital but for simplicity our purposes here we will take venture capital to be focused on making many, smaller investments in earlier stage businesses and private equity to be focused on making fewer, larger investments into established companies.