This is Part 5 of Terem’s comprehensive guide to API Monetisation. Be sure to also read Part 1 on the importance of API monetisation, Part 2 on direct monetisation strategies, Part 3 on indirect monetisation strategies, and Part 4 on reducing costs and saving time.

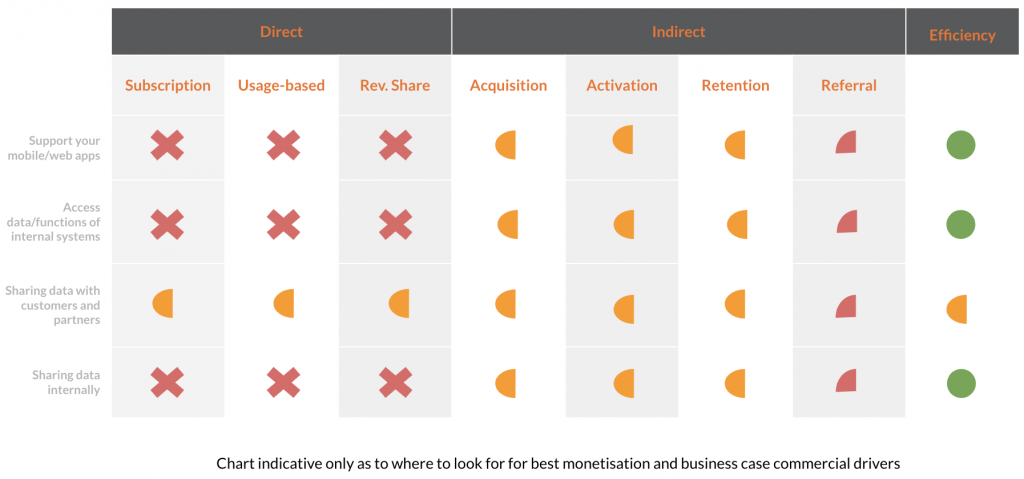

The use cases for your API will fit some types of monetisation models better than others.

This section of the API Monetisation Guide gives an overview of API use cases organised by industry sector, and demonstrates how well each of them work with different monetisation strategies.

The industry list we’re working off includes:

- Cross-sector

- Business SaaS Products

- Financial Services

- Retail and eCommerce

- Content and Media

This list is by no means exhaustive. We haven’t covered sectors like manufacturing, health, or government—it’s simply a demonstration of how to map use cases to monetisation models. You’ll also see some overlap across industries.

Cross-sector

This section looks at common API use cases across all industry sectors.

Support your mobile and web apps

This is one of the simplest and most common use cases for an API. Any organisation looking to build mobile and web apps need to use an API to provide your products access to the same functionality.

So, given the API is supporting internal teams, how do you think about monetisation? Here are some ideas:

- Cost savings: You won’t have to build the same functionality twice in different apps.

- Efficiency: You can launch more apps/products faster in the future.

It’s a longer bow to draw to attribute revenue.

Access data and functions of internal systems

This is another common use case for APIs—using an API or single API layer to enable access to data and functionality between internal, or third party, systems and apps.

When it comes to monetisation, you need to look for a customer facing problem that the API can enable. Some ideas:

- Retention: How can the API provide your customer facing apps with the ability to increase retention?

- Acquisition/Activation: How could API access to internal systems allow you to better acquire or activate customers?

Otherwise, you can make the same business case around efficiency that is mentioned in the section above.

Data sharing

Another common use case across sectors with APIs is to enable data sharing within the organisation—or with partners and customers—by providing access to a single interface that connects disparate systems.

If your data has value to partners or customers, then there is a strong case to be made around monetisation. If your API is only going to be focused on internal users, then you will need to look for opportunities to attribute revenue from a customer facing use case, or build your business case around efficiencies.

Sharing data with customers and partners

When your data has value to partners or customers you can monetise through:

- Direct, Subscription: Customers purchase a subscription to the API in order to access it on an ongoing basis.

- Direct, Revenue share: You share in the revenue your partners make because they have access to the data sharing API.

- Indirect, Retention: Customers and partners are more likely to stay for longer, because they can access the data they need. You can attribute some of the revenue from customers that use the data sharing API to your team.

Sometimes your API might connect your business to an entirely new type of customer, which requires meaningful consideration. For example, an airline loyalty program that decides to partner with a bank to share data on customers, purchase habits, and preferences.

It’s important to note that monetising in this way can be a substantial undertaking, akin to building a new venture within the business.

Sharing data internally

If your use case is only going to be focused on internal users, then you will need to either tie your API to a revenue-driving, customer-facing use case, or use efficiencies to build your business case.

Business SaaS Products

This section looks at common API use cases for Software-as-a-Service (SaaS) products that are sold to businesses.

Essential for function

In B2B SaaS, there are situations where an API is absolutely essential for making the product work. That is, without use of an API the customer will not be able to get their job done.

A prime example of this is in payments, where a SaaS company might provide a web app, mobile app, or payments device to merchants—the merchant will need to connect this to their Point-of-Sale (PoS) System to make proper use of the offering. So, an API is almost non-negotiable. It is needed for the PoS to capture transactions.

In this situation you have some options for monetisation:

- Indirect: Attribute a portion of revenue from customers to the API.

- Direct: Where the value of the API versus the rest of the SaaS product can be clearly delineated, you can charge directly for the API.

Stickiness of product

A key role APIs can play in B2B SaaS is making the core product stickier.

An example of this is cloud accounting software. While customers can freely use the software without use of the API, the more they connect their own software to the API the harder it becomes for them to change.

The most appropriate monetisation model is indirect attribution through retention.

Grow revenue through ecosystem

Another common role APIs play in B2B SaaS is enabling an ecosystem around the core product.

One of the best examples of this is Atlassian. Atlassian provides a marketplace for other developers to create and integrate their SaaS products, and then takes a cut of any revenue made on the marketplace.

An ecosystem allows you to monetise the API directly or indirectly:

- Direct, Revenue share: You share in the revenue your ecosystem partners make through the marketplace.

- Indirect, Retention: You attribute revenue to your API through the impact it has on retaining customers. You can measure this through how many ecosystem integrations a customer is using (for example).

There is also a case to be made around efficiency. With an ecosystem, you no longer need to build every function or feature that a customer asks for because your partners can do it for you.

Financial Services

This section looks at common API use cases for Financial Services.

Sign up new customers or give quotes

A strong use case in financial services is for an API to allow partners and third-parties to sign up new customers, or at least provide them with quotes for an organisation’s products.

For example, a broker being able to use their own systems to quote a customer, which is driven by calls to an insurer’s API.

This allows you to indirectly monetise your product by attributing revenue from new signups that come via the API.

Transfer money

APIs can be used in financial services to transfer money between accounts or institutions.

If a transaction fee is involved then you can monetise the API directly, through usage-based pricing. You may also monetise directly with a flat fee for use of the service.

However, if there isn’t a transaction fee then then you will need to look to indirect methods of measuring monetisation. You will need to quantify how many customers are being retained as a result of the API, and attribute the API’s contribution to revenue this way.

Accept money and payments

APIs can be used to accept money and payments, as a payment gateway. Merchants and other third parties can use your API to receive money from credit cards and other payment methods.

Stripe is one of the most well known payments providers that originated as an API-first service.

Revenue can be directly attributed to the API, usually through a combination of revenue share and per-transaction pricing. Some payment gateways also include a monthly or annual subscription/license and support fee.

For some financial services organisations, you may also want to add in the indirect revenue the API brings in. Consider how having a particular service may also help retain customers.

Claims processing

APIs can be used to assist with claims processing in insurance and similar industries.

Claims APIs are most likely to see efficiency gains as a key part of the business case. You may also be able to find indirect monetisation opportunties by attributing revenue from customers that are retained as a result of being able to handle claims via an API.

Make trades

APIs can be used to make trades – that is, to buy or sell shares, options, or other financial instruments. Many of the algorithm traders use this approach. More and more, some fintechs may want to embed the ability to make a trade into their services.

Trading APIs can usually attribute revenue directly – the fees gained from the trades made through the API. However, where trading is also taking place through other methods, the API’s monetisation may be through indirectly attributing the impact on acquisition and retention of customers.

Retail & eCommerce

This section looks at common API use cases for Retail and eCommerce businesses and operations.

Allow orders/purchases through third parties

APIs can be used to allow third parties to order or purchase goods from a retailer or wholesaler.

APIs that take orders or purchases can be monetised:

- Directly: Through the revenue or margin sold via the API. You may share in the revenue with your partners, or you may charge them a monthly license fee.

- Indirectly: By attributing a portion of the revenue to the API (useful where there are alternate methods to order through)

- Efficiency: Through the costs saved by avoiding a manual process (if that is the alternative)

Provide price/product/stock data with partners

APIs can be used to provide data on prices, products, and stock to partners and third-parties.

APIs that provide this data can generally be monetised as follows:

- Directly: You may be able to charge a direct subscription for using the API. Alternatively, you may charge a percentage of sale that a partner makes for usage (somewhat like an affiliate model).

- Indirectly: You attribute revenue from acquisition and retention of partners, resellers, or customers that use the API.

- Efficiency: Through the costs saved by avoiding manual processes, you can articulate the APIs value.

Shipping, logistics, and taxes

APIs can be used to send data to your customers, partners, and other third-parties on the shipping, logistics, and taxes that might be associated with your goods.

APIs that provide this data can generally be monetised as follows:

- Directly: You may be able to charge a direct subscription for using the API.

- Indirectly: You attribute revenue from acquisition and retention of partners, resellers or customers that use API.

- Efficiency: Through the costs saved by avoiding manual processes, you can articulate the APIs value.

Financing of a purchase

APIs can also be provided to allow a customer to finance a purchase.

APIs that provide purchase financing can generally be monetised as follows:

- Directly: As a share of the interest payments on the financing or as a pay-per-usage fee.

- Indirectly: As a share in the overall revenue of the purchase attributed to the API providing financing.

- Efficiency: Where an API has reduced the costs, effort, and time involved in manual financing, the value of the API can be articulated in this way as well.

Content & Media

This section looks at common API use cases in content and media such as news websites, creators of premium content, publishers, and others.

Share content

APIs can be used to share content. YouTube provides an API that allows you to search content for instance. Spotify lets you share your playlists and other data.

APIs that share content can generally be monetised as follows:

- Directly: By charging for use of the content (although not that common), or as a share of revenue gained from any sales or revenue that comes from visitors that arrive through the shared content (e.g. the affiliate model)

- Indirectly: By attributing a portion of your revenue to customers or users that arrive or are retained as a result of the API.

Republish/reuse/embed content

APIs can be used to republish, reuse, or embed content. YouTube lets you embed videos in a website. Other content APIs are somewhat more sophisticated, allowing you to consume the underlying content in its raw format (e.g. XML) then reconstruct the content how you please.

APIs that allow you to republish, reuse, and embed content can generally be monetised as follows:

- Directly: Consumers of the API pay for the content or access level on a pay as you go or subscription.

- Indirectly: You attribute revenue to the API based on the customers it helps acquire or retain. You can also attribute revenue based on content purchases that take place elsewhere as a result of the API.

Submit content

APIs can be used to accept content submissions from users, customers, and partners.

APIs that allow content submission can generally be monetised as follows:

- Directly: It is hard to see a pathway to directly monetise submissions – most organisations are not looking to charge content creators.

- Indirectly: You can attribute revenue gained from content created via the API.

- Efficiency: Submission via an API will likely save time and reduce costs compared to other forms of submission.

Summary

This list hopefully provides you with an overview of use cases for APIs, and some of the ways to monetise them. This overview doesn’t serve as a replacement for genuine research and analysis on your part. You really need to consider your specific business, your customer, their problem to determine the best way to monetise. There were also many other industries and use cases that were not covered by this section—such as telecommunications, devices/things, and Government. come to mind). This guide simply aims to demonstrate ways of getting the most value out of your technology investment, and to show the thinking behind monetisation strategies for certain use cases that you can extrapolate to your own industry.

More reading on APIs

- Part 1 of this guide: The Importance of API Monetisation For All Businesses

- Part 2 of this guide: Direct Monetisation Strategies

- Part 3 of this guide: Indirect Monetisation Strategies

- Part 4 of this guide: Reducing Costs and Saving Time with APIs

- API Strategy: When to Build and Where to Start

- The 37 Dimension API as Product Assessment Framework

Scott Middleton

CEO & Founder

Scott has been involved in the launch and growth of 61+ products and has published over 120 articles and videos that have been viewed over 120,000 times. Terem’s product development and strategy arm, builds and takes clients tech products to market, while the joint venture arm focuses on building tech spinouts in partnership with market leaders.

Twitter: @scottmiddleton

LinkedIn: linkedin.com/in/scottmiddleton