Neobanks are on the rise. Monzo raised $144m recently to be valued at $2.6bn, Prospa successfully listed on the ASX with a market cap of $720m (AUD), Judo Bank raised $140m (AUD) and many more have hit similar achievements.

I was curious to understand some of the realities of what they are doing so I performed research into the tech stacks being used by the neobanks on their primary domains.

This provided a surprising amount of insight into their growth channels and approach to support, going beyond just the programming language and hosting provider they were using. Hopefully the research gives some insights to the fintech sector and entrenched financial companies looking to keep pace.

The analysis is divided up into sections based on the categories of technology:

- Growth (Analytics, Ads, Other Growth)

- Technical (DevSecOps, Languages/Frameworks, Content Hosting, Other Technical)

- Support and Communications

- Other

The companies I looked at were (in no particular order):

The research was by no means a comprehensive survey, rather a sampling of some of the more prominent neobanks and fintechs (that could move into neobank territory).

Growth

The most unexpected result of the research was that it gave insight into the growth strategies and tactics being followed by fintechs and neobanks. Through the Martech tools and platforms they’ve integrated we can understand how they are going to market.

Analytics

Every company had Google Analytics but then some went further with video recordings of user sessions (HotJar, Inspectlet, FullStory, CrazyEgg). One company, Zip, has opted to also use a more advanced product analytics platform in Amplitude.

Ads

With ads everyone except Judo was using Facebook and not just using Facebook but using everything on offer (Facebook Pixel, Conversion Tracking, Custom Audiences, etc). I couldn’t help but think my data might have been off.

Where it became interesting was the varied use of LinkedIn, Twitter and remarketing. LinkedIn was most likely down to the customer they were targeting.

There were also some other advertising platforms and tools in the mix like Branch and DataXu.

Other Growth

Many of the neobanks are employing AB Testing and Feature Toggling as part of their stack, using tools like Google Optimize 360, CrazyEgg and Optimizely.

Some are also using marketing automation platforms like Marketo and Salesforce.

Technical

Languages and Frameworks

Three of the neobanks used WordPress and the rest were a mix of AngularJS, ReactJS, PHP, Ruby on Rails and ASP.NET. WordPress seems like a good fit for those that were prelaunch. It also makes sense that others like Afterpay and Zip, who’s main website is also their ‘app’, were clearly using custom built sites and taking advantage of alternative CMSs like Contentful.

Content Hosting

Cloudflare and AWS CloudFront were the two most common caching services used by the neobanks. It was interesting to see that many were using multiple services like this on their sites. For example, one neobank uses AWS CloudFront, Cloudflare and Microsoft’s Azure CDN.

DevSecOps

Monzo, Vault and Prospa were the only three banks to include security and privacy related services in their stacks. For example, Monzo is using Report URI, a service that helps detect web application attacks from the moment they begin. Vault is using OneTrust. Prospa is using Proofpoint URL Defense.

When it comes to DevOps, 5/9 neobanks had some form of error and performance monitoring: New Relic, Sentry, Rollbar or Azure Monitor.

Some of the banks were making use of Mailgun and Amazon SES for transactional email delivery within their apps.

Support and Communications

The tech stack that stood out for customer success, support and communications for a fintech/neobank was ZipMoney. Zip has Zendesk Chat, Zendesk and elev.io (a service for delivering inline help/FAQs). Some of the other neobanks also had live chat technology integrated or something like Zendesk.

Other

Some of the banks made use of Apple’s Smart App Banners to provide a trusted way of getting users to install or open the related app on iOS. Others, somewhat surprisingly, didn’t feature this. It might be a quick win.

Method

The method I used to do the research was to build a table of the neobanks I was aware of, then look each of them up on builtwith.com and note down the tech they were using.

You can keep scrolling to access the data tables that were created to summarise the data found on builtwith.com.

Some Thoughts

In doing the research, I formed some opinions:

- There seems to be complete use of open source technology, unix based services and cloud platforms to deliver these sites. A quick browse of the neobanks, larger 100 year-old competitors shows almost the complete opposite. Use of cloud and open source can only be a source of strength for neobanks/fintechs as experience tells me it will allow them to move faster than their bigger peers.

- It was great to see the recent generation of marketing tools like CrazyEgg and Optimizely in the mix.

- If you’re looking to build or rebuild in this space then wordpress is an excellent technology if your app is somewhat separate and doesn’t need to be part of your marketing site (your .com)

- Judo has some work/catching up to do it seems. Judo doesn’t have anywhere near the number of ad, growth and technology platforms in play as the other neobanks.

- If you’re a neobank and you aren’t maxing out your use of everything Facebook has to offer then you need to be aware your competitors are doing this.

- LinkedIn and Twitter are interesting additions that must help with targeting businesses and (maybe) tech people respectively.

- Adding security and privacy services seems a quick win for most of the Australian neobanks.

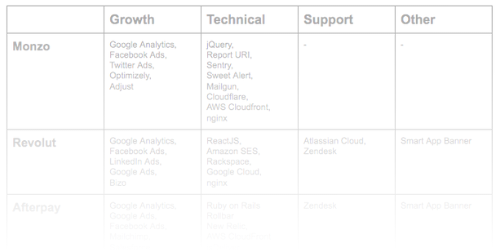

Data Tables

There are three data tables:

- All Data – contains the technology used for each neobank broken down by category (Growth, Technical, Support, Other)

- Growth Data – contains a breakdown of growth technology by neobank, broken down into subcategories.

- Technical Data – contains a breakdown of technical technology by neobank, broken down into subcategories.