If there is one constant theme in my work across companies and organisations of all shapes and sizes, it is (mis)understanding your customer. So, I’ve put together a checklist for understanding your customer to help you quickly get everyone aligned on how well you really understand your customer.

When you understand your customer, magic happens, and brilliant results follow. If you don’t put time into understanding your customer, then you’re setting yourself up for a battle or, worse, failure.

On the surface, everyone agrees that they need to understand their customer. I’m yet to meet someone that disagrees with this statement. However, disagreement almost always comes about on how well you (or they) understand the customer. The impact of this is the effort, or lack of effort, that then gets invested in activities like Product Discovery and customer research.

Where this checklist comes in is that it is a tool to move beyond an argument of “you don’t understand your customer”, “yes, I do”, “no, you don’t”, “yes, I do…”. Instead, give a more objective way of assessing the maturity of customer understanding through a list of best practice artefacts that are present in successful product teams that understand their customer.

The Checklist

This Checklist for Understanding Your Customer is broken into Key Artefacts and Supporting Material.

Key Artefacts

- Customer Value Proposition (CVPs) with JTBD

- Customer Journey (including Buying Journey)

- Buyer Personas (needed for marketing more so than product building, JTBD is more useful)

- Market Sizing

Supporting Material

This information is important, as it leads to more informed key artefacts and provides additional insights into the customer.

5. Customer Interviews x10 (formal interviews, not “my mate said” – must be within your target that match your CVP. In many cases, you will have interviewed people that will help lead to CVP, but they won’t be in your target – these don’t count)

6. Behavioural data

7. Competition, substitutes, complements

8. Assumptions and gaps

9. Optional:

a. Survey Results

b. Focus Group Results

Key Artefacts

1. Customer Value Proposition (CVPs) with JTBD

The Customer Value Proposition (CVP) canvas with a clear statement of the customer’s Job(s)-to-be-Done (JTBD) is the central artefacts in a mature understanding of your customer. They show that thought and effort have been put into clearly defining who the customer is, what they need to do, and how your company/product/service solves this.

Ideally, there will be some accompanying notes that explain the decisions and discussions that have resulted in the CVP canvas.

2. Customer Journey

A Customer Journey includes the customer’s Buying Journey, showing how the end-to-end view of how the customer finds, assesses, purchases or signs up, then gets their Job-to-be-Done done, and is retained, is another essential artefact in understanding your customer. The presence of this shows thought has been given to the entire customer lifecycle.

3. Buyer Personas

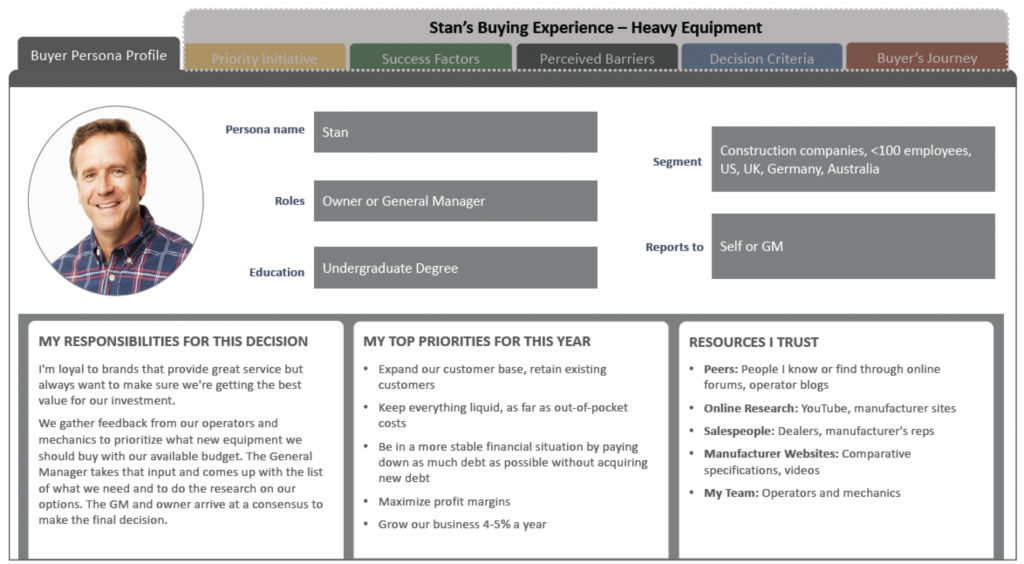

Buyer Personas provide you with an understanding of the various people involved in purchasing or making a decision to purchase your product/service. While there is some argument about the value of personas in comparison to Jobs-to-be-Done, at the end of the day, you can’t over understand a customer, it’s more of a continuum, and so personas are included on this checklist because they will help you better understand the customer.

Personas are particularly useful in go-to-market activities like sales and marketing, where it is hard to target a Job-to-be-Done.

4. Market Sizing

Research on market sizing is another artefact that shows a mature understanding of the customer – a total addressable market.

A word of caution, often market sizing takes priority or precedence over a CVP. Sometimes it is used as a replacement. The more you have, the better your understanding, but the CVP and JTBD will provide richer insights from which to build a successful product, feature or release from.

Supporting Material

5. Customer Interviews

You can only really understand your customer by talking to them. It sounds simple but seems to get lost. You can’t understand your customer without doing this. This is why the results – video recordings of interviews, transcripts, notes, summaries – are important to look for in assessing your or your stakeholders’ understanding of the customer.

There are a few points to look out for here:

- The number of interviews conducted. There isn’t a set rule here, but you want to see enough that you can gain some confidence that any insights aren’t swayed too much by one individual. As a non-scientific rule of thumb: 10+ is a good number.

- The interviews need to have been formal, scripted customer interviews.

- Ideally, the interviews need to have been with your target customer. If you ran interviews to explore who your target is, refined your target customer and realised some of the interviews don’t fit your target customer, then you may need more interviews.

You can use some practices from this webinar to assess the interview artefacts against best practice.

6. Behavioural data

Behavioural data is data that captures the observed actions of users or customers. It’s one thing for someone to tell you what they want, but a much more valuable data point to observe how they actually behave.

Compare what you have against this list of 12 behavioural data types to ensure the data you have is valid and appropriate.

7. Competition, substitutes, complements

You want to see some thought has been put into how your customers are currently solving their Job-to-be-Done or might solve it in future.

In assessing the depth of customer understanding, you’re looking for everything from a strategic analysis of competition through to screen recordings of a competitors product.

8. Assumptions and Gaps

The best teams know where their gaps in knowledge are. They know the assumptions they are making and their biases. Ideally, they have stated these and shared them openly.

This is where the scientific method and a hypothesis-driven approach come in.

9. Optional:

a. Survey Results

Surveys can help provide a larger-scale assessment. Ideally, the surveys have been designed to specifically assess Jobs-to-be-Done, or are generally just well designed. Be cautious with surveys in product as they can also mislead if designed poorly, and they often lack the fidelity (of an interview, say) to make concrete decisions with. So, when determining the maturity of customer understanding, make sure you assess the questions asked, the structure of the survey and how the survey was conducted.

b. Focus Group Results

Focus Groups, interviewing a group of (potential) customers together can help validate some of the key artefacts. Look for transcripts and video recordings, also be aware of who the participants were, and how well they fit your target or proposed target customer and Job(s)-to-be-Done.

Scott Middleton

CEO & Founder

Scott has been involved in the launch and growth of 61+ products and has published over 120 articles and videos that have been viewed over 120,000 times. Terem’s product development and strategy arm, builds and takes clients tech products to market, while the joint venture arm focuses on building tech spinouts in partnership with market leaders.

Twitter: @scottmiddleton

LinkedIn: linkedin.com/in/scottmiddleton