Spinning a business out of an established company isn’t a straightforward process. This Spinout Framework provides you with a comprehensive view of the various elements that you will need to pull together to succeed at spinning a new business out.

Spinouts aren’t usually straightforward for a variety of reasons. Spinouts don’t happen frequently for any single business, so there isn’t a defined pathway. Spinouts need the different groups (silos) within a business to collaborate with each other. Spinouts cut straight to raw emotions of greed, ambition and power.

By using a framework like the one put forward below, you can get some way towards removing or reducing the challenges that spinouts face. A framework can help you identify issues before they occur, help you move faster and get the right result. Importantly, if you’re the one championing the spinout, it will help take the edge out of what will be a challenging process at times and give you the patience and persistence you need to run the gauntlet.

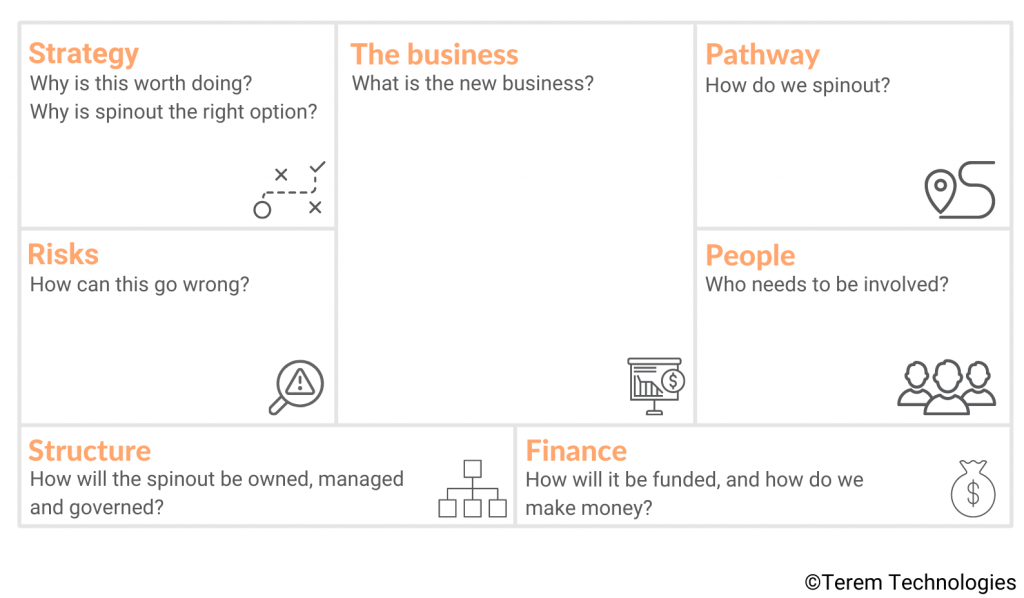

The spinout framework is made up of these key elements:

- Strategy – Why is this worth doing? Why is spinout the right option?

- Business – What is the new business?

- People – Who needs to be involved?

- Pathway – How do we spinout?

- Finance – How will it be funded, and how do we make money?

- Structure – How will the spinout be owned, managed and governed?

- Risks – How can this go wrong?

Strategy

For the strategy element of spinning out, there are two key questions to answer:

- Why is this worth doing?

- Why is spinout the right option?

You will want to try to answer these at the outset with the knowledge that you will refine this as you work through the other elements of the canvas and iterate on the spinout over time.

When answering these questions, start with the strategy that (hopefully) exists in the parent companies. An established business will have a strategy even if it isn’t written down or articulated somewhere. You need to link the spinout to the parent’s strategy in some way.

The spinout might directly assist with the parent’s strategy, it might address a portion of the strategy, or it may not address any of the strategy. There isn’t a clear right or wrong answer; you’ll need to consider each situation individually.

Business

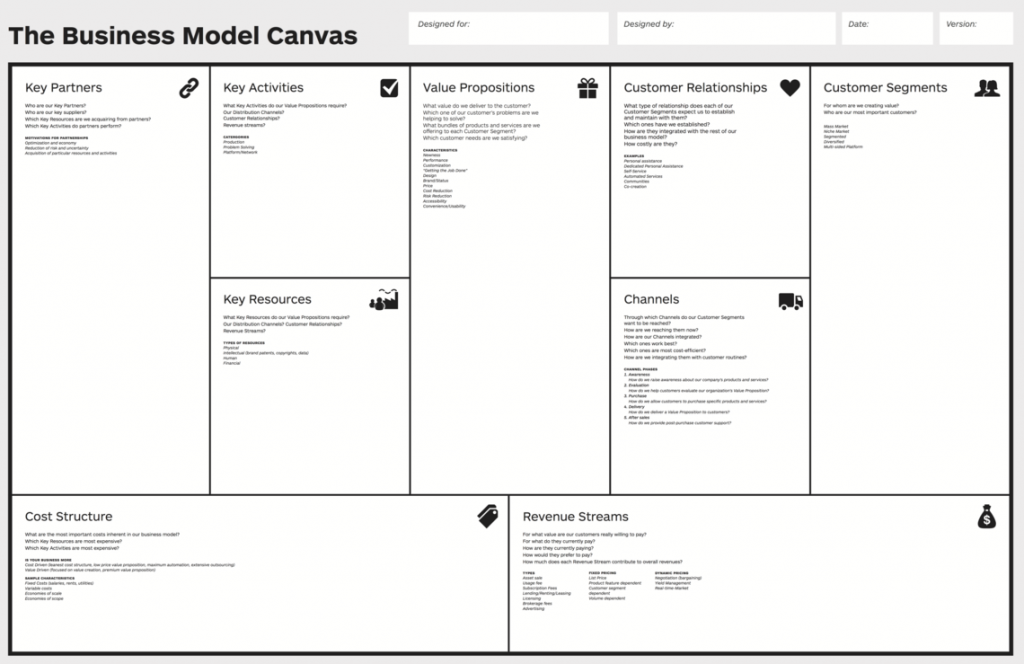

This element is where you describe the business itself.

This is best done with a business model canvas.

As you progress through the process of spinning out, you will also need to put together some standard documents that any business looking for funding would need to prepare, like:

- Forecast Profit & Loss

- Planned OKRs

People

This element of the Spinout Canvas focuses on the people who need to be involved in the spinout. These are people who will need to be involved in the process of spinning out, sign off on the spinout, support the business once it is live and work in the business.

The specific types of people you need to consider are:

- CEOs – you need CEO involvement for a spinout. Spinouts are different enough for most businesses that the CEO is often the only one with enough context to make spinouts happen (or not).

- Sponsors – if the parent company is big enough, you will also need a sponsor who will likely be a different person than the CEO. This will be a senior executive interested in the spinout itself who can champion it and help you navigate through the parent.

- Team – the core team that will work on the spinout together. This will likely be a mix of people from across the different companies involved. This team will own the spinout.

- Supporters – people from different business units (finance, legal, innovation, security, IT, etc.) that will need to be across what you are doing, help you build your case and in some cases, provide much-needed information or advice.

It is worth completing a stakeholder management plan and updating this as you progress through the spinout process because the success, failure and friction of your journey will come back to how well you’ve understood and engaged your stakeholders.

I want to reinforce the involvement of the CEO. Get the CEO involved early, and you’ll get an immediate sense of the appetite to spinout. Don’t go so early that you haven’t built the support or the clarity on what you are doing and why, but go a bit earlier than you might think. You also don’t want to waste your time on something that the business would never consider. If the CEO is interested, then you’ll have the support you need to push through some cross-cutting barriers you will need to overcome.

Pathway

This element of the Spinout Canvas looks at how you are going to spinout. The process of getting from an idea through to a separate entity established and operating independently.

There are a few different aspects to the pathway:

- Decision Pathway: The pathway to getting a decision on whether to spinout

- Process of spinning out: the process of establishing the independent entity.

1. Decision Pathway

You need to get a formal decision from the parent companies on whether to spinout or not. You will either need to create a new process and committee or, more likely, go through an existing process or committee.

Most organisations have an existing process or approach to funding new initiatives or ventures, or doing mergers and acquisitions. You will want to piggyback on the most appropriate of these. In larger organisations, you will need to be careful that you don’t end up proceeding down the wrong one.

Make sure you understand the delegations and authority the committee has. Are they able to establish a new entity? If so, under what conditions? If not, is there a better group with the proper authority? Is this a stepping stone to get to the right group?

2. Process of spinning out

Once you have a decision to proceed with the spinout, you need to actually spin it out. This will involve finance, legal, executives, and if there is a partner, the equivalents from their side. This is where you work through the details – contracts, forms, accounting activities, and more – required to establish a new entity, that is set up with everything it needs.

Some of the allowances you will need in your spinout plan are:

- Drafting corporate documents for the new entity (shareholders agreement, constitution, subscription agreement and any other agreements you require).

- Finding and negotiating the terms of employment for key team members.

- Finalising any business plans and financial plans

- Transferring intellectual property and any other assets (or access to assets) that the spinout needs to succeed.

- Communications with customers, staff and other stakeholders that may be affected by the spinout.

Make sure you have regular involvement from someone empowered to make decisions in the process of spinning out (e.g. a weekly meeting). There will almost certainly be issues that haven’t been addressed yet that need to be resolved.

If you’ve determined that you want external capital to be invested into the spinout, then you will also need to allow time for this. It is somewhat of a different process to the nuts and bolts of establishing a new entity.

Finance

This element of the Spinout Canvas looks at the financials of the spinout. In particular:

- Funding

- Forecasts

- Cost and Revenue Centres

- Returns

Each of these are covered in more detail below. You may need to iterate through this to get the right mix.

1. Funding

You need to determine whether the spinout will be funded through capital, debt or cash flows. You may also need to work with external partners to secure the appropriate funding.

2. Forecasts

You will need the financial forecasts for the spinout business (forecasts of the cash flow, revenue, and profit & loss). There is some overlap with the work you will have done under the Business element of the Spinout Canvas here. The reason why this item appears again is that, for this part of the canvas, you might provide more detail or rework it as you work through items like capital and returns.

3. Cost and Revenue Centres

You will need to work out where you will attribute costs and revenue associated with the spinout in the parent company accounts.

As the full or partial owner of an entity, there may be accounting needs to make this attribution. There may also be management needs to make this attribution.

Whether a spinout is using the parent’s resources or the parent becomes a customer, you will also need to work out where in the accounts (e.g. which cost centre) the spinout’s revenue or expenses will appear.

4. Returns

You need to determine where your returns will come from the spinout. You need to know how you are going to get a return on your investment to date and any investment you are making in the future.

The types of returns you want to think about are:

- Capital gains from the spinout being acquired.

- Dividends from the cashflow

- Revenue received through some other arrangement with the spinout (e.g. license fees from intellectual property or assets, reseller agreements, revenue sharing)

- Increases in parent company share price as a result of greater revenue or revenue with a different profile.

I have had conversations about returns that centre on data, knowledge and other intangible assets. These are useful, but they aren’t as strong as solid financial results.

The area of returns is where large companies can struggle. The returns from spinouts that are early in their lifecycle are difficult to quantify. These earlier spinouts won’t easily fit the M&A or corporate finance teams usual approach to valuing initiatives (it’s hard to use discounted cash flow in a startup). So you need to combine “hard” finance methods with some intuition and art to get to a view on returns.

Structure

This element of the Spinout Canvas is focused on the structure of the spinout. This covers:

- Governance

- Ownership

- Parent Structure

The organisation structure for the spinout itself is covered under the Business element of the Spinout Canvas.

1. Governance

Governance covers the Board of the new entity, reporting and compliance.

This is where you determine the number of board seats, what types of matters the board will deal with or that shareholders will deal with. You’ll lay out the types of reporting the parent company (or companies) need from the spinout. There may also be compliance requirements given the industry, activities of the spinout, or the needs of the parent(s).

2. Ownership

Here is where you address the ownership structure of the spinout. This can be the most controversial and challenging part of establishing a spinout.

Arriving at an ownership model that works for everyone is a topic unto itself. For our purposes here, you want to make a determination broadly on the type of position your company needs to hold: minority, majority, equal or indifferent.

Each type of position comes with trade-offs. Determine the type of position that makes the most sense for your company before looking at specific amounts. It will make discussions and planning easier for every party involved.

3. Parent Structure

This is where you want to look at where the new spinout fits within the parent structure. There could be differences in the legal fit (e.g. what is registered with authorities) and where the entity reports for month-to-month management.

You will also need to look at where support from the parent will come from. Spinouts often need help navigating their parents.

Risks

Finally, you need to look at the risks involved in establishing a spinout.

Some questions to start from here are:

- How could this go wrong?

- What assumptions are we making in our financial forecasts? What data do we have to prove/disprove these assumptions?

- What allowance do we have for goals taking longer than expected or being more expensive to achieve?

- How could this impact our reputation?

- What security, privacy or data risks does this spinout present?

- What if we don’t do this? Do we miss an opportunity?

Read more:

- The Must-Read Book List for Building New Product Ventures

- The 4 Questions Product & Venture Executives Must Focus On

Scott Middleton

CEO & Founder

Scott has been involved in the launch and growth of 61+ products and has published over 120 articles and videos that have been viewed over 120,000 times. Terem’s product development and strategy arm, builds and takes clients tech products to market, while the joint venture arm focuses on building tech spinouts in partnership with market leaders.

Twitter: @scottmiddleton

LinkedIn: linkedin.com/in/scottmiddleton