The state of public APIs for the ASX100, Australia’s biggest companies, isn’t great. Still, there are some promising examples of companies that are going the right way and, surprisingly, it isn’t our tech companies (the WAAX stocks).

In order to understand the state of public APIs, we put together a list of all the public APIs we could find for the ASX100 last year (there were 19). Then we went through each API and assessed the 19 companies’ public API platforms against our 37-Dimension API-as-Product Assessment Framework. We also wanted a benchmark, so we assessed two of the best examples of APIs globally: Stripe and Twilio (API-led businesses with multi-billion dollar valuations).

Key Highlights

The key takeaways from the analysis are:

- Surprisingly, only three (3) technology companies on the ASX had public APIs: Afterpay, Xero and REA. Altium, Resmed, Cochlear, SEEK, WiseTech and the others did not have accessible public APIs. While we know some do have APIs – some we’ve worked with directly in the past – they’ve obscured contracts and red tape.

- The banks have mostly implemented the bare minimum public API for meeting their open banking obligations, except for some shining lights like NAB. NAB’s developer-friendly API platform scored well against best practices and the benchmark (see in-depth analysis here). Most are a long way off NAB and even further from the benchmark set by the fintech Stripe. Some, like ANZ and Bendigo, barely scrape into the spirit of “minimum viable public API”, publishing what is essentially a glorified word document as their API portal/documentation.

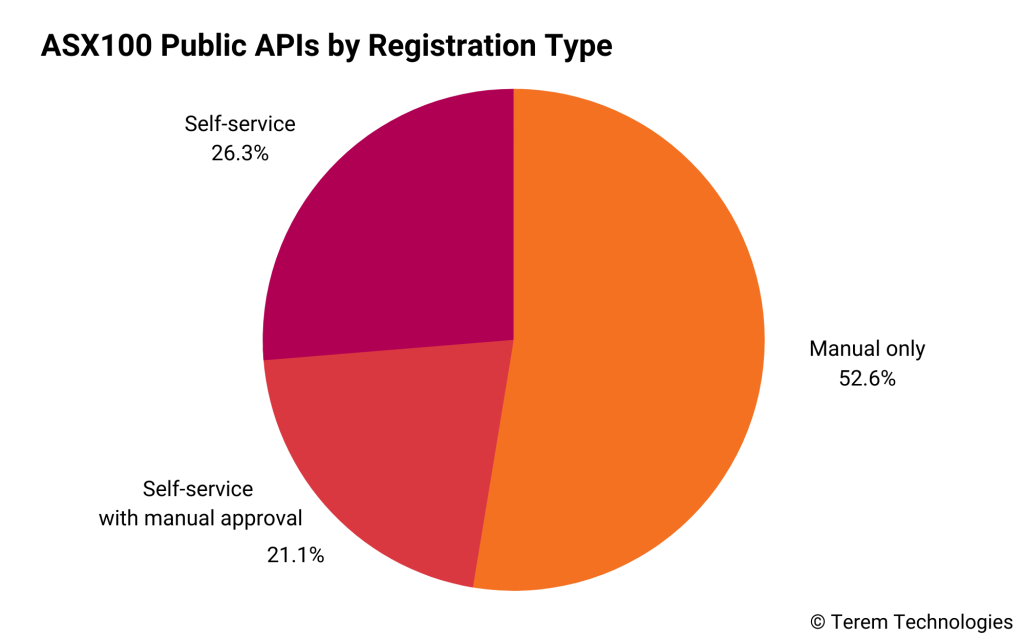

- The majority of companies (73.7%) are making it too hard for their ecosystem and partners to build with them. Just over half (52.6%) required manual approval (e.g. emailing them or calling a business development person) just to get access to the API and documentation. Then, 21.1% provide some level of self-service but next require manual intervention to get you truly up and running.

- With the exception of Xero, every company had room to improve against the benchmarks of Stripe and Twilio.

- The key areas of assessment needing the most improvement across the board were Onboarding, As Product and Community.

- API Design and Documentation was generally well done across those that provided it.

- The above points generally reflect the ASX100’s high technical/engineering capabilities, alongside a nascent but maturing product management capability.

I want to make a special mention/clarification about some of the Open Banking APIs. One could make the argument that they are easy to onboard to and self-service because you can query some public information endpoints (“tell me a list of products the bank has”). However, this on its own isn’t really in the spirit of a self-service public API platform.

Companies Assessed

The ASX100 companies with public APIs that we looked at were:

- Afterpay

- ASX

- Australia and New Zealand Banking Group Ltd

- Bendigo and Adelaide Bank Ltd

- Commonwealth Bank of Australia

- Insurance Australia Group Ltd

- JB Hi-Fi Ltd

- Link Administration Holdings Ltd

- Macquarie Group Ltd

- National Australia Bank Ltd

- REA Group Ltd

- SEEK

- Suncorp Group Ltd

- Tabcorp Holdings Ltd

- Telstra Corporation Ltd

- Virgin Money Uk Plc

- Westpac Banking Corporation

- Woolworths Group Ltd

- Xero Ltd

The list of public APIs was put together in late 2020, so companies that have joined the ASX100 since then haven’t been included.

Twilio and Stripe were selected because they are their APIs. Their success in achieving their multi-billion dollar valuations is due to their ability to create APIs that are the best in the world. We realise there are other companies we could have used or included in the benchmark, but for our purposes, we found this was adequate and that Twilio and Stripe reflected our experiences with other best-in-class public APIs.

These companies all had APIs that we could find. If we couldn’t find their API, then we didn’t consider it publicly available, so it didn’t pass the first hurdle of being a public API.

Download the Data

You can download the data set we put together while performing the analysis here.

If you think we missed a company, then please let us know, and we’ll update the analysis.

Scott Middleton

CEO & Founder

Scott has been involved in the launch and growth of 61+ products and has published over 120 articles and videos that have been viewed over 120,000 times. Terem’s product development and strategy arm, builds and takes clients tech products to market, while the joint venture arm focuses on building tech spinouts in partnership with market leaders.

Twitter: @scottmiddleton

LinkedIn: linkedin.com/in/scottmiddleton